GNU - Start of an economic chain reaction?

While elections continue to loom large around the democratic world in 2024, the dust has largely settled after South Africa’s own trip to the polls.

After intense uncertainty during the election period, a Government of National Unity (GNU) ultimately emerged post negotiations, representing 72% of the seats in parliament and a solid majority of votes cast by the electorate.

Investors are now naturally focused on the best strategies for long-term investing in the GNU-normal. Could this be the catalyst for positive economic change in South Africa and what impact can it have on South African asset prices which remain depressed?

Revitalising the reform agenda

Unlike Ramaphoria 1.0 in 2018, the market this time appears to understand that the road to economic turnaround and improvement will not be straight or easy. The election outcome does, however, provide a favourable foundation from which South Africa can continue the desperately needed process of renewal, reform and change. While the headlines will not necessarily always be positive, and noise levels will likely remain loud, what is promising is the seeming commitment from senior politicians in the respective GNU parties to want to make it work.

In an environment characterised by low levels of both consumer and businesses confidence, we are encouraged to see this reemphasis and reinvigoration of a reform agenda. Work done during the previous administration is continuing and is critical to improve local and foreign sentiment in South Africa’s future path. Reform and legislative changes spanning a wide range of areas are underway, most notably in state-owned enterprises (SOEs).

Some light at the end of the tunnel for SOEs

Eskom and Transet, the two poster children in terms of SOE underperformance in recent years, have both demonstrated the positive effect from enacted reform and private sector participation.

For example, Transnet’s freight rail underperformance in recent years has cost South African exporters and, by implication, the fiscus dearly. The Transnet recovery plan, new management, and private sector involvement are showing early signs of improvement - admittedly off a low base.

At Eskom, we also see an improvement in underlying fundamentals in the availability of power and its operations thanks to both private sector investment (in both renewable energy projects and residential solar installations for example) and a focus on operational turnaround within the SOE. With over 160 days without loadshedding at the time of writing and with Eskom projecting limited loadshedding over the next 4 to 5 years, if the current electricity availability factor (EAF) can remain above the mid-60% range, we’re currently in a position where we can feel greater security in the outlook for electricity supply.

Basic critical infrastructure delivery and availability is a prerequisite link to get the economic chain reaction moving!

Boosting confidence is key to investment and growth

Empowering the private sector with both the confidence and environment to spend and invest will be required if South Africa is to ultimately start lifting economic growth towards an aspirational 3% or greater. Only once growth is lifted above the zero to one percent level that we have been stuck at for the better part of a decade can we start addressing the more structural issues such as job creation, education and healthcare. This won’t happen overnight. Further potential good news for consumers and investment is that local interest rates have likely peaked amid a global easing cycle that has already started.

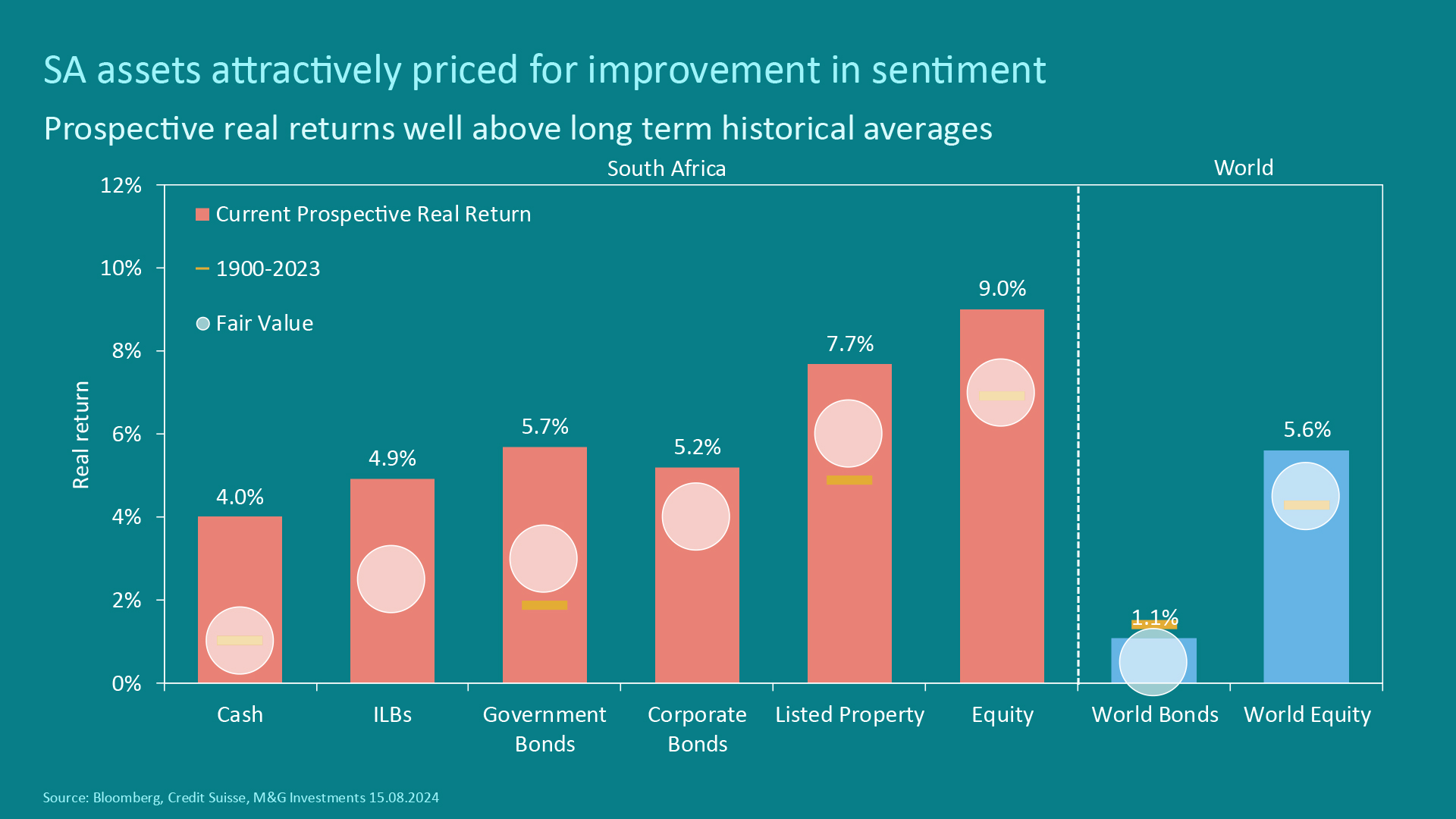

South African assets are attractively priced for an improvement in sentiment

Across local asset classes, we see plentiful opportunity for investors currently. In our opinion, when we look at the prospective real returns on offer, they are comfortably above what we believe to be their long-term fair value.

Looking at South African equities as an example, total returns have been below average over the past decade. The underlying companies making up the equity market have, however, delivered, with aggregate real earnings growth roughly in line with historical trends. It’s effectively been the derating of the market (lower price earnings ratios, lower price to book ratios, higher dividend yields etc.) that has dragged down returns. If that derating merely halted and companies aggregate growth remain unchanged, returns going forward would be much improved.

We believe the GNU-normal offers a real opportunity for South Africa to turn a corner. While it won’t be without challenges, and the task is long, we’re encouraged by the initial positive momentum. A period of stability, continued incremental reform and execution of improvements in SOE delivery is needed to catalyse a chain reaction of improved confidence, spur greater private sector investment and ultimately lift national growth to enable the nation’s structural issues to be addressed.

To explore more on this topic, we invite you to watch a webinar in which Portfolio Manager Leonard Krüger and Client Director Zyron Melton explore investment strategies for navigating this new GNU-normal as well as an update on the M&G Inflation Plus Fund and M&G Balanced Fund.

To invest in our funds today, speak to a trusted financial adviser or contact our Client Services Team on 0860 105 775 or email us at info@mandg.co.za for more information.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter