Investment Focus: M&G Balanced Fund gets the best of uncertain markets

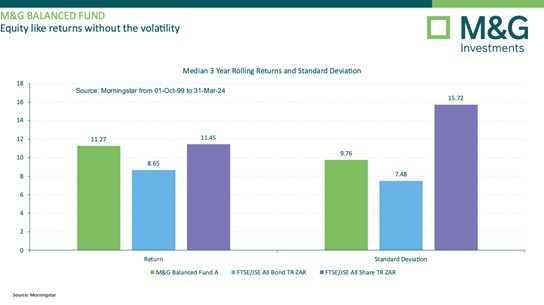

In the nearly 25 years since its launch, the M&G Balanced Fund has proved to be an excellent example of what a “Balanced Fund” should be: it has produced equity-like returns for investors without the higher volatility associated with equity investments.

The graph shows how the fund has returned 11.3% p.a. from October 1999 to 31 March 2024, almost beating the FTSE/JSE All Share Index’s equity return of 11.5% p.a., and with a standard deviation (a measure of volatility (or risk) much lower than the JSE. It also solidly outperformed the All Bond Index’s 8.7% p.a. return over the same period, but with higher risk.

This type of performance is typically what longer-term investors are looking for: growing capital faster than inflation and with fewer and less dramatic downturns along the way than a 100% equity portfolio. The key to the M&G Balanced Fund’s strong long-term performance? The careful asset selection and wide portfolio diversification by M&G Investments’ team of experienced professionals.

Diversification is the primary characteristic of a Balanced-type fund that allows investors to enjoy relatively high returns with relatively lower risk than an equity fund. The key is balancing the many different sources of risk associated with each instrument to create a portfolio that is resilient in different types of investment environments. Resilience can be reinforced through the price paid for an investment as well: purchasing an asset at a solid discount to fair value leaves room for error or unexpected market disruptions.

The M&G Balanced Fund is strongly diversified across global assets like equities, bonds, property and cash instruments, as well as their South African equivalents. Currently, South African equities and bonds are our preferred assets due to their very cheap valuations compared to history and to many other developed and emerging market assets. In our view, SA equities and bonds are offering ample compensation for the risks involved in holding them, and SA bonds are particularly attractive due to their very high real yields and the potential for further gains as the SA Reserve Bank starts to lower interest rates later this year, as widely expected.

Globally, US equities are expensive, in our view, but other global equity markets offer fair to attractive valuations, and we are taking advantage of these to diversify in developed and emerging equity markets. 30-year US Treasury bonds are especially good diversifiers for South African equity risk and are also offering attractive yields for investors, so we are holding these as well as certain emerging market sovereign bonds. With higher-than-expected inflation being a risk, we have included global inflation-linked bonds with attractive real yields for some downside protection, and also hold somewhat higher-than-usual levels of global cash given these assets’ higher-than-usual yields and low risk amid the uncertainty around global growth this year. Cash availability also allows us to take advantage of any buying opportunities that might arise unexpectedly.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter