Market Observations: Q3 2024

Market overview

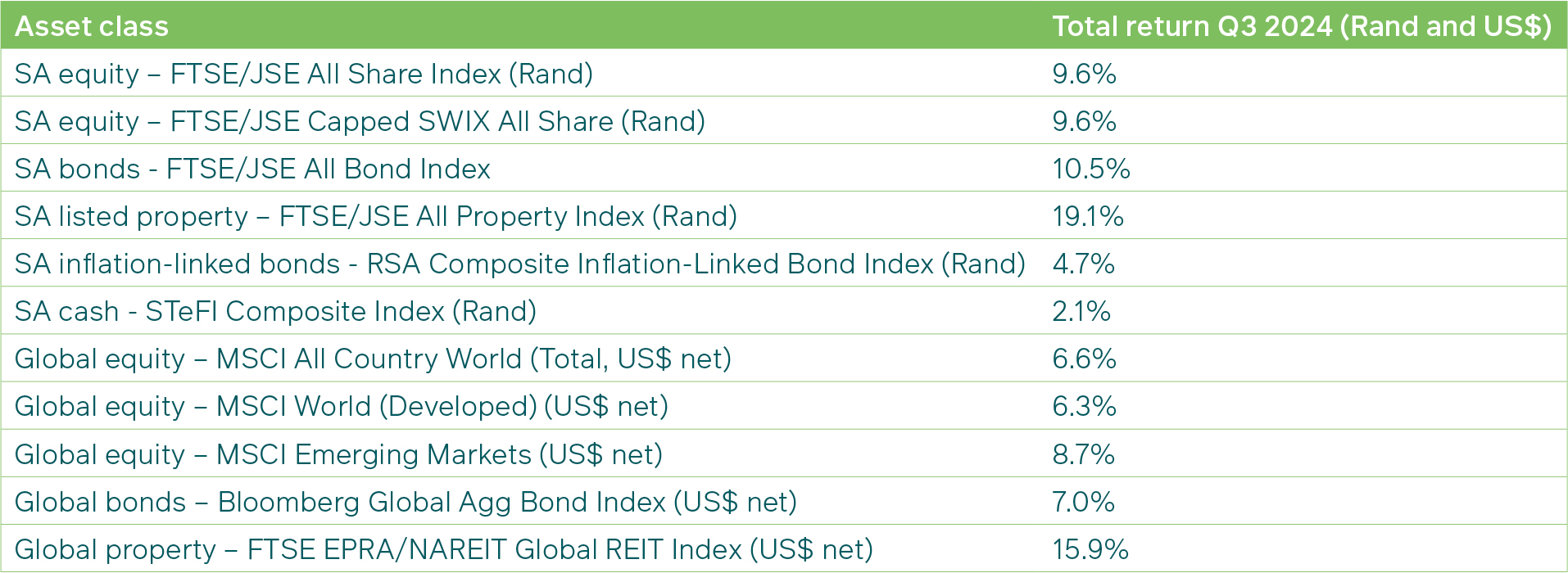

The third quarter of 2024 (Q3) witnessed notable fluctuations in global financial markets, driven by diverse economic signals, a shift among major central banks toward easing monetary policies and geopolitical tension. In mid-September, the US Federal Reserve (Fed) implemented a sizable interest rate cut of 50 basis points, lowering the target range to 4.75%-5.00%. This shift propelled global equity markets to new heights, while weakening the US dollar to major currencies.

In August, the Bank of England (BoE) reduced its main interest rate from 5.25% to 5%, maintaining this level through September. The BoE also announced plans to sell an additional £100 billion in bonds over the next year, thus scaling back its quantitative easing efforts.

The European Central Bank (ECB) also continued the easing trend, cutting its deposit rate by 25 basis points to 3.5% in September. Improved economic data and interest rate cuts in Europe and the US contributed to a recovery in European stocks following a selloff earlier in August.

Significant market movements were also driven by substantial stimulus measures from the Chinese central bank aimed at bolstering the economy. The Hong Kong Hang Seng Index surged, returning 22.3% for the quarter.

In contrast, the Bank of Japan (BOJ) raised rates by 15 basis points to 0.25% on July 31, marking the highest level since 2008. This unexpected hawkish move triggered considerable volatility in local equities and high-carry currencies, with the Nikkei 225 Index experiencing sharp declines early in August, before recovering those losses by month-end. As economic data from the US shifted expectations for the Federal Reserve, the Yen strengthened, leading to increased short-term volatility in Japanese equities and across regional Asian markets.

The Chinese government’s stimulus measures resulted in a notable 23.6% rally in the MSCI China Index (in US$).

The International Monetary Fund (IMF) reported a stabilisation in global economic growth as the effects of previous interest rate hikes faded and falling inflation enhanced consumer disposable income. The IMF global growth forecast for 2024 is 3.2%, and its 2025 outlook is at 3.3%. Overall, global conditions have improved, although risks remain. A US ‘soft landing’ appears increasingly likely following the worst inflation surge in a generation, but it is not guaranteed.

Middle East tensions have reached even higher levels. The market reaction to these events have been short-lived, but as the situation escalates, we would expect to see moves to a more risk-off environment.

In the US, Treasuries rallied leading up to the Fed’s decision, while rate cuts pressured the U.S. dollar and led to a rally in US equities. This environment contributed to a rally in global bond markets, particularly reflected in the Bloomberg Global Aggregate Bond Index delivering 7.0% (US$) for the quarter.

Equity markets continued to perform well in the third quarter. Global equities (as measured by the MSCI All Country World Index) recorded a total return of 6.6% in Q3 compared to 2.9% in Q2, while emerging market equities (MSCI Emerging Markets Index) rallied another 8.7% in Q3 from 5.0% in Q2 (all in US$).

Emerging market equity returns were led by strong performances from China, South Africa and India. South Africa and India are still benefiting from a market-friendly election outcome while China saw a rebound amid the stimulus measures announced to aid its economy.

In South Africa, improving sentiment from a market-friendly election, better economic conditions, and easing monetary policy led to gains in asset prices and the Rand, with the FTSE/JSE All Share Index rising 9.6% in rand terms. Key contributors included Listed Property (19.1%), and Financials (13.7%) while Resources declined by 1.1%. Industrials was one of the standout performers benefitting from the month-end China rally as Naspers and Prosus prices reacted to the strong move in the Tencent share price. From a South African investor perspective, the move had beneficial implications as Tencent followed the market higher sending the share prices for Naspers and Prosus up by about 14% in September. In addition, the stimulus announcement led to higher commodity prices, which had a positive impact on the local resource sector.

South African bonds performed strongly, with the FTSE/JSE All Bond Index rising 10.5% (in Rand) over the quarter and adding more positive returns to the total for the year. Bond yields continued the downward move we have seen since the conclusion of the GNU election results.

The Rand also strengthened to the end of September to the best levels since the start of 2023 having gained 5.6% against the US dollar and 1.7%% against the Euro, but it depreciated 0.1% against the Pound Sterling.

United States

In the US, investor sentiment toward equities cooled slightly in anticipation of the Federal Reserve’s rate decision. While the much-anticipated rate cut was no surprise, the Fed did, however, surprise markets by cutting rates by a sizable 50 basis points in September, marking the start of its first easing campaign in four years. This significant cut reflected signs of moderating inflation and a weakening labour market. The focus has shifted towards the quantum of future rate cuts before the market will get too worried about a possible US recession. Comments from Fed chair Powell also helped ease any market concerns as it suggested future rate cuts should be more muted depending on economic data and inflation reporting.

August’s CPI came in at 2.5% y/y, aligned with expectations and down from 2.9% in July, while the core PCE price index, the Fed’s preferred inflation measure, rose to 2.7%y/y. Q2 GDP exceeded expectations at 3% (q/q annualised), largely driven by consumer spending, while the downwardly revised Q1 GDP stood at 1.3%. The Fed maintained its growth forecast for 2024 at 2.1%. During the quarter, the Dow Jones gained 8.7%, the Nasdaq increased by 2.8%, and the S&P 500 rose by 5.9% (all in US$).

UK

In the UK, the Bank of England (BOE) kept its main interest rate steady at 5 % during its September meeting, following a reduction from 5.25% to 5% in August. UK CPI held steady at 2.2% y/y in August, aligning with expectations as the BOE aims to return inflation to its 2% target.

UK GDP grew by 0.7% in Q2 2024, slightly below expectations, following 0.3%y/y growth in Q1, with underlying growth showing weakness in the first half of the year. In the UK National Election on 4 July, the Labour Party achieved a decisive victory, unseating the Conservatives after 14 years. Pre-election uncertainty caused some volatility, but the outcome was anticipated in the local financial markets. In Q3 2024, the FTSE 100 Index returned 8% (in US$).

Euro area

In the Euro area, the European Central Bank (ECB) lowered its main refinancing rate to 3.65% during its September meeting, as anticipated. August CPI was reported at 2.2% y/y, down from 2.6% in July and, aligning with the consensus, with the preliminary September number printing at 1.8%, below the ECB’s 2.0% target.

Q2 2024 GDP growth surpassed expectations at 0.6% y/y but was revised down to 0.2% q/q, compared to 0.3% in Q1. France’s CAC 40 rebounded with a 6.5% return in Q3 after a 7.3% decline in Q2, while Germany’s DAX delivered a strong 10.4% return for Q3 (both in USD).

Japan

The Bank of Japan (BOJ) unexpectedly raised rates by 15 basis points from 0-0.1% to 0.25% on the last day of July, the highest level since 2008, and signaling a more hawkish stance than anticipated. This decision led to significant volatility in local equities and high-carry currencies, with the Nikkei 225 Index experiencing a sharp decline in early August but recovering by month-end. After a strong return of 13.2% in Q1, the Nikkei retraced some gains in Q2 with a -7.6% return, followed by a 8.5% USD gain in Q3.

Japan’s August core CPI rose to 2.8% y/y, aligning with forecasts and accelerating for the fourth consecutive month. In a widely anticipated move, the BOJ maintained its benchmark interest rate at 0.25% at its September meeting, in its efforts to normalise monetary policy. The BOJ’s decision came as it seeks to transition away from a long-standing ultra-easy monetary stance while safeguarding the economy. Japan’s economy grew at an annualised rate of 2.9% in the second quarter, surpassing the projected 2.1%.

China

China’s economy is showing signs of a modest recovery, but a slow start to the second half of the year is increasing pressure on the world’s second-largest economy to implement additional stimulus policies. This came amid ongoing challenges, including a prolonged housing downturn, persistent deflation, rising debt issues, and escalating trade tensions.

The People’s Bank of China (PBOC) announced broad policy easing measures to shore up a flailing economy. The central bank cut the rate on one-year medium-term lending facility (MLF) loans to some financial institutions to 2% from 2.3%. Additionally, the reserve requirement rate was reduced from 10% to 9.5%. Some questions around the Chinese economy remains, such as the health of their property market and the impact these changes will have on the recovery in that sector, but the market clearly thinks the initial actions were positive.

China’s August CPI increased to 0.6% y/y from 0.5% in July but came in lower than the forecasted 0.7%. The uptick was mainly due to higher food costs from weather disruptions, rather than a recovery in domestic demand as producer price deflation worsened.

After years of stagnation, Chinese stocks surged in September, marking a significant turnaround from earlier in the quarter. The rally was driven by the government’s aggressive stimulus plan, which included rate cuts and support for the struggling real estate sector. Hong Kong’s Hang Seng Index returned 22.3% and the MSCI China Index rose 23.6% in Q3 2024 (both in US$).

Emerging markets

The MSCI Emerging Markets Index achieved a robust 8.9% return, primarily fuelled by gains in China and South Africa. The MSCI China Index ended the quarter as one of the top performers, surging 23.6%, while South Africa and India benefitted from positive sentiment following their market-friendly national elections, returning 16.3% and 7.4%, respectively (both in USD). Conversely, the MSCI Turkey Index fell from its position as the previous quarter’s top-performer, ending the period down 12.5%. Brazil’s Bovespa gained 8.5%, while South Korea’s KOSPI declined by 2.2% (all in US$).

Commodities

Commodity markets experienced mixed results in Q3. China’s stimulus announcement led to higher commodity prices by quarter end. Gold prices surged to record highs, making gold the standout performer with a 14.0% increase, driven by rising geopolitical tensions and monetary easing. In contrast, platinum saw a slight decline of 1.5%, while palladium rose by 2.7%. Zinc gained only 5.3% in Q3, after 23.4% in Q2. Additionally, aluminium, copper, and lead recorded increases ranging from 3.1% to 5.3%.

Brent crude oil experienced significant volatility this quarter, driven by mixed sentiment surrounding China’s stimulus plans, potential production increases from OPEC+ members, and escalating tensions in the Middle East. OPEC+ has announced plans to boost production by 180,000 bpd monthly, following Saudi Arabia’s shift from a $100 oil price target to a focus on regaining market share. Oil prices dropped during the quarter, primarily due to rising global supply and weak demand growth in China year-to-date. The price of Brent crude oil started the quarter at a high of $86.76/bbl but declined 17.5% by quarter end.

South Africa

South Africa continued to enjoy buoyed sentiment off the back of a market-friendly election outcome. The re-rating continued into asset classes against the backdrop of improving economic conditions. The economy grew by 0.4% q/q in Q2 2024, following stagnation (0.0% growth) in Q1. Household consumption emerged as the largest contributor to overall growth, reflecting renewed confidence and spending power among households. The first-half output slightly missed expectations, but the South African Reserve Bank (SARB) projected growth of 0.6% in both upcoming quarters. While medium-term growth forecasts have increased due to rising confidence, a stable electricity supply and reform momentum, investment remains a concern, having contracted for four consecutive quarters, highlighting the need for recovery to support sustained growth.

Meanwhile, CPI decreased to 4.4% y/y in August, below the SARB’s target and forecasts of 4.5%, down from 4.6% in July. This marks the third consecutive month of inflation slowdown. Following the Fed’s lead, the Monetary Policy Committee (MPC) implemented a widely anticipated 25 basis point rate cut to 8%. This move aligns with the consensus view that a less restrictive stance supports sustainably lower inflation in the medium term. Currently the local forward rate agreement (FRA) curve is pricing in another 125bps of cuts in the rest of the cycle so the expectations would be for gradual 25bps cuts to come through over the next 12 months. The FTSE/JSE All Share Index returned 9.6% (in Rand) for the quarter.

How have our views and portfolio positioning changed in Q3 2024?

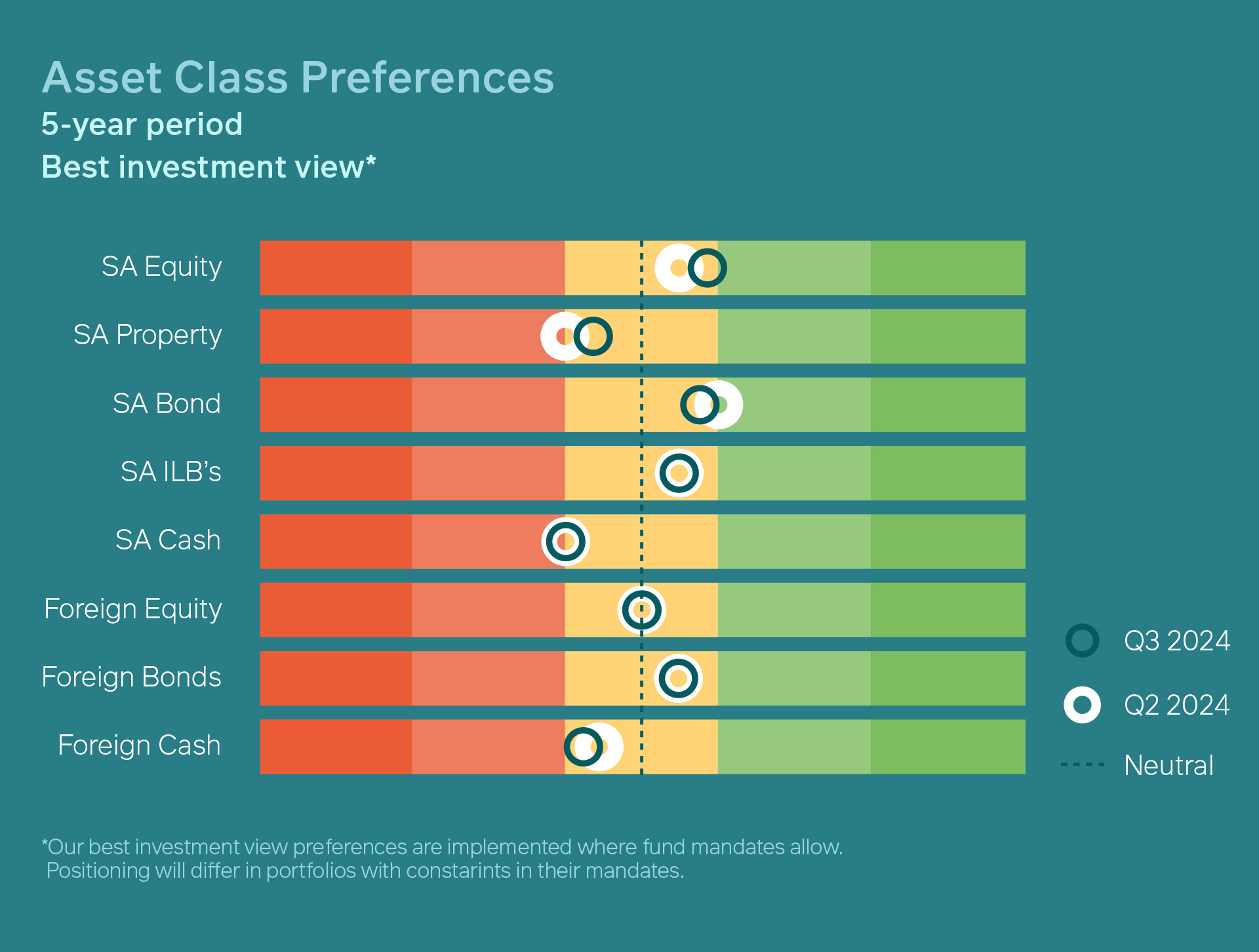

During the third quarter we have made some changes to the size of our positions due to the rally we have seen in domestic asset classes, but the broad direction of fund positioning has remained the same.

Starting with our view on offshore versus local asset allocation we have left our positioning unchanged for the quarter and continue to prefer domestic assets over foreign exposure, despite the strong rally we have seen in our local market post the GNU announcement. From a valuation perspective, SA equities are coming off a very low base and continue to screen relatively cheap compared to other markets. On the bond side our 10-year yield is still pricing real returns in excess of our fair value assumptions and therefore remains one of our key holdings across the funds.

Within the global holdings our positions are currently towards a small underweight in global equity with a bigger underweight to the US market in order to take overweight positions in more fairly priced offshore markets. We also retain our small overweight positions in global bonds and global cash. During the quarter we acted on the market sell-off in early August to add some Korean equity exposure to the funds and reduced our China and other EM Asia exposure at the end of the quarter after the strong rally we saw in the Chinese market post their stimulus announcements. In addition to this we also broadened out our carry basket in the funds to short out some of the major currencies, such as the USD and EUR, in favour of higher carry trades such as in Latin American (Latam) markets.

In global equities, the MSCI ACWI 12-month forward P/E rose slightly to around 18X at the end of the quarter with fairly volatile intra-quarter moves. We made use of the opportunities the volatility gave us to change some of our positioning on the equity side by adding to Korea and/or Japan in our funds after the early August market sell-off to go slightly overweight equities in our global positioning but then reduced the asset class again at the end of September to take profits in our China exposure after the strong post-stimulus move in that market. The valuation for the S&P 500 continues to screen as expensive to other markets with a forward P/E increase to about 21.5X during the period and therefore we continue to hold our underweight to the US in favour of cheaper markets such as the UK, Europe, Korea and other emerging markets, such as Mexico.

Within global bonds we did not make any changes to our overweight duration position during the quarter and continue to hold exposure to the long end of the US Treasury curve as well as more muted positions in UK gilts and EM bonds with high real yields in undervalued currencies.

We continue to stay underweight global corporate credit given the narrow credit spreads and the unattractive risk-reward payoffs in those instruments.

Our house-view continues to favour SA equities at the end of Q3 2024 and we made use of the post-election waiting period at the start of the quarter to add to our existing equity exposure across the funds. SA equity valuations when looking at the 12-month forward P/E ratio of the FTSE/JSE Capped SWIX Index moved higher to around 10.7X, due to a rally in share prices. On a Price-to-Book basis the market moved slightly less cheap from 1.6 at the start of the quarter to just over 1.7 by quarter end, but still trades cheap compared to history and relative to other markets. The portfolios benefitted from the equity team’s move to add more SA-exposed stocks pre-election, such as increasing the bank and retail exposure in the funds.

In Q3 one of the bigger changes to our positioning was to decrease the extent of our underweight exposure in the SA listed property sector, given the improving fundamentals we have witnessed in that segment of the market. The rate-cutting environment, sharp reduction in bond yields and improved balance sheet efficiency of the property companies should take away some of the headwinds the sector has had to contend with since the Covid period. However, we continue to hold the sector as an underweight in our funds given the sharp rally in prices over the short- and medium-term periods.

Another change we made during the quarter was to lock in some of the performance we experienced in our overweight SA nominal bonds position. Local bonds have rallied strongly since the GNU announcement and although we are still positive on the asset class, we feel the speed of the move has been so sudden that it would be beneficial to take some of our position off. Real yields remain attractive compared to our fundamentals and therefore we continue to hold an overweight position to the sector, but at a reduced scale.

Our house-view portfolios continue to have no meaningful exposure to SA inflation-linked bonds (ILBs) as our preference has been for nominal bonds in favour of ILBs, but we do hold some of these bonds in our real return portfolios such as the M&G Inflation Plus Fund. We made no changes to our ILB positioning during Q3. Real yields for these instruments are attractive at current levels, especially as the price move in ILBs have lagged behind nominal bonds during the quarter but given liquidity constraints and the advantage of being in nominal bonds in a rate-cutting environment we have kept our relative positioning in place in Q3.

Finally, our portfolios remain tilted away from SA cash as the interest rate-cutting environment will lead to lower positive real cash rates over the medium term. We continue to prefer the risk-adjusted returns we receive in the SA equity and bond space and would expect that gap to open even more as local interest rates are cut further beyond this point.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter